What are Facilities and Administrative (F&A) costs?

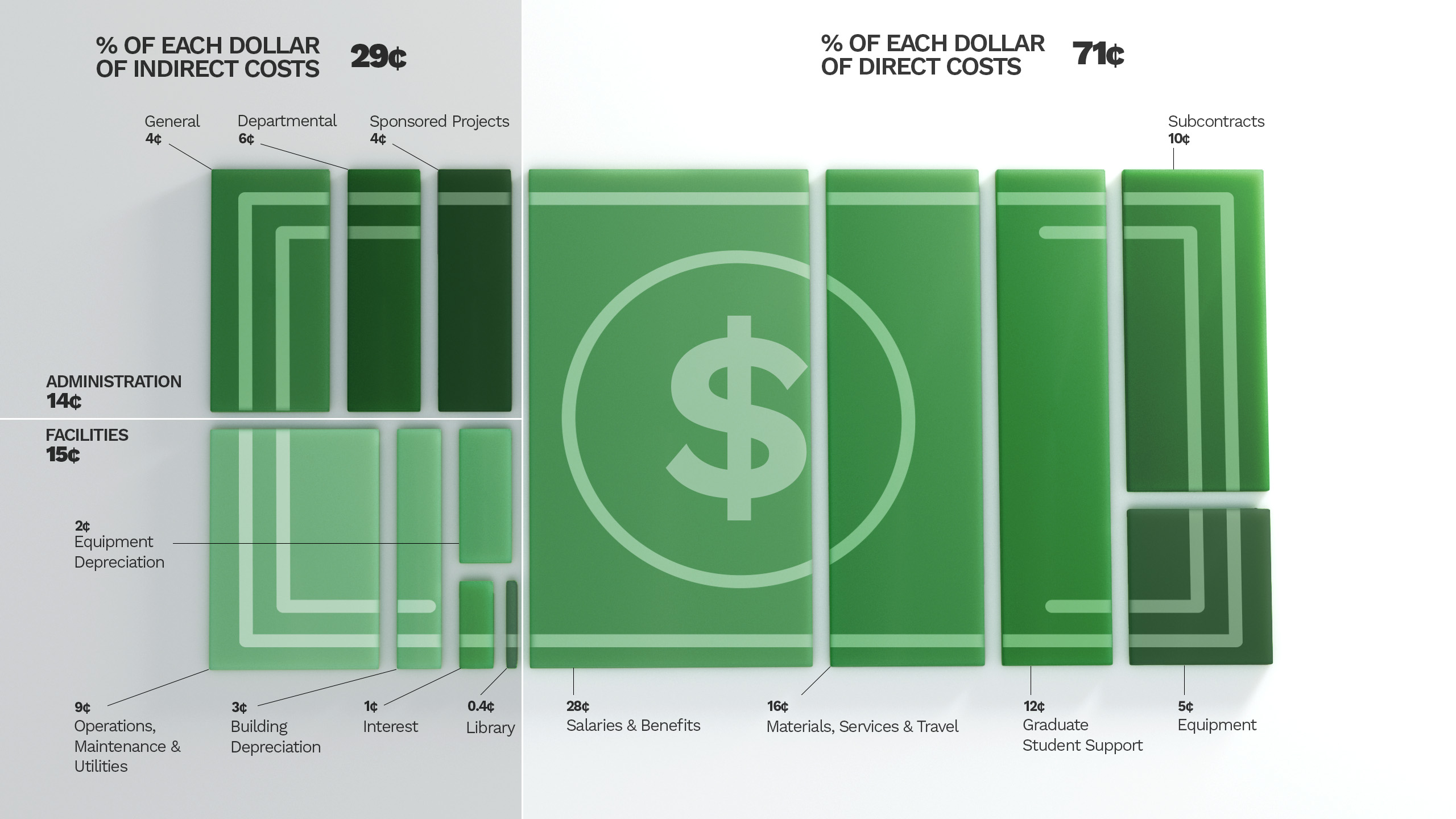

Facilities & Administrative (F&A) costs, also referred to as indirect costs, are expenses that support the overall infrastructure for and administration of research projects but cannot be directly attributed to any specific project. They include the costs of building and maintaining state-of-the-art research laboratories and facilities, libraries, physical plant operation and maintenance, utility costs, compliance with national security protections (e.g., export controls, cybersecurity and research data security), safety protocols (e.g., human and animal subject protections), radiation safety and hazardous waste disposal and personnel required to support essential administrative and regulatory compliance work.

Significantly, F&A costs are only a partial reimbursement to the institution for costs already incurred in supporting research activities. F&A reimbursement helps offset the institutional costs of conducting research but does not fully reimburse all expenses associated with the conduct of research.

Background information on this page is based on an FAQ guide published by the Council on Governmental Relations.

How was UNL’s F&A rate determined?

F&A cost reimbursement rates are established in accordance with prescriptive federal guidelines and based on the costs already incurred and documented in the university’s audited financial statements and systems. F&A rates are determined through a negotiation with the Department of Health and Human Services in accordance with the federal guidelines. UNL’s most recent rate agreement was approved on Dec. 17, 2020, to go into effect July 1, 2021, and remains in effect until a new agreement is negotiated. F&A rates are based primarily on historical cost data and often do not keep pace with the increasing costs of research compliance, technology and facility maintenance.

The reimbursement rate is a percentage of a subset of direct research costs (nota percentage of total award). Some direct research costs — like equipment, capital expenditures, charges for patient care, tuition remission, rental costs for off-site facilities, scholarships and fellowships and the portion of each subcontract that exceeds $25,000 — are excluded from the base for F&A cost calculation purposes. This remaining amount is known as modified total direct cost (MTDC).

For example, after reviewing the costs of a university’s research projects during a base year, and considering anticipated changes such as increases in MTDC, a university and the federal government may determine that an amount equal to 50% of research MTDC is appropriate for the federal government to contribute toward F&A expenses. In that case, if the federal government awards a university $450,000 for the direct research portion of a grant, of which $365,000 is the modified total direct cost, then it also awards $182,500 for F&A cost reimbursements, for a total of $632,500.

These overall institutional F&A cost rates are applied uniformly to each research grant as its direct funds are spent, avoiding the very tedious, expensive and inefficient process of computing the F&A expenses for individual awards – which would add additional costs for both the government and the university.

UNL has negotiated rates for sponsored research conducted on campus and off campus, for the Agricultural Research Division and the broader campus, instruction, cooperative extension services and other non-research related sponsored programs, further ensuring the reasonableness of the rates charged. The current rates can be found in the most recently negotiated rate agreement.

How is accountability built into the F&A reimbursement system at UNL

The U.S. Department of Health and Human Services completes a comprehensive review of the university’s rate proposal. During that review, the agency will confirm that federal guidelines have been followed, unallowable expenses and activities that do not benefit federal research (e.g., fundraising) have been removed from proposed F&A costs and the chosen allocation methods are reasonable and in accordance with the prescribed methodology. The agency will require adjustments if any problems are found and may further reduce rates if it considers them unreasonable (e.g., if they have increased significantly from the prior rate negotiation).

UNL routinely undergoes federal audits to ensure that it has requested reimbursement only for appropriate expenses, including that it has not overcharged the government for F&A costs. These include annual independent financial and compliance audits subject to Government Auditing Standards detailed in the University of Nebraska System Annual Comprehensive Financial Report.

Why is there so much variation in F&A rates between institutions?

F&A cost rates can vary significantly across institutions due to differences in costs across different regions of the country, urban versus rural environments, the type and complexity of the institution’s research portfolio and other variables that impact the cost of doing research.

The universities that have the best combination of climatic conditions, utility rates and/or labor costs will generally have a lower rate for facility operations.

How does UNL use the F&A funds it recovers?

As stated above, F&A is a reimbursement of expenditures to cover some portion of the indirect costs incurred as a function of completing a sponsored research award. F&A is not revenue; it is a reimbursement of costs already incurred. As such, the use of F&A funds, once recovered, is not restricted to any particular use. A useful analogy is the reimbursement of expenses for the business use of a personal automobile. When an employee uses their car for a business trip, the university reimburses the employee at a standard rate per mile. When the employee receives the reimbursement, they are under no obligation to use the funds for auto-related expenses. Similarly, the campus is under no obligation to use the F&A in a certain way.

To determine how to distribute F&A recovery, UNL critically examines what is needed to ensure the university maintains and grows its research infrastructure, which is essential to remain globally competitive and to contribute to research, discovery and innovation important to Nebraska and the United States for greater societal good. For example, technology is rapidly advancing, and universities must obtain and sustain major research instruments, such as high-powered microscopes and imaging equipment. If UNL does not have this critical infrastructure, it cannot contribute to additional discovery within the current state of science and technology globally.

Are there costs that UNL does not recover?

Indirect cost rates are made up of two components: 1) facilities costs, which include buildings and utility costs, and 2) administrative costs, which include personnel to ensure compliance with national security protections, safety protocols, and essential administrative and regulatory compliance. There is a 26% cap on the administrative portion of the indirect cost recovery for universities regardless of how much they must spend on administrative costs to ensure research is conducted safely, securely, efficiently and effectively. Universities are the only federal grantee or contractor subject to a limitation on federal payment of administrative costs. The COGR 2023 Survey of F&A Cost Rates found that the average calculated administrative component of the 120 responding institutions was more than nine percentage points higher than the 26% cap (35%).

The Federal Research Dollar at UNL

Additional resources

FAQs and Issue Briefs

- Facilities & Administrative (F&A) Costs of Research One Pager

- Frequently Asked Questions (FAQs)

- Comparing Foundations to Federal Government Research Support

- Breaking Down the Costs of Federal Research at Universities